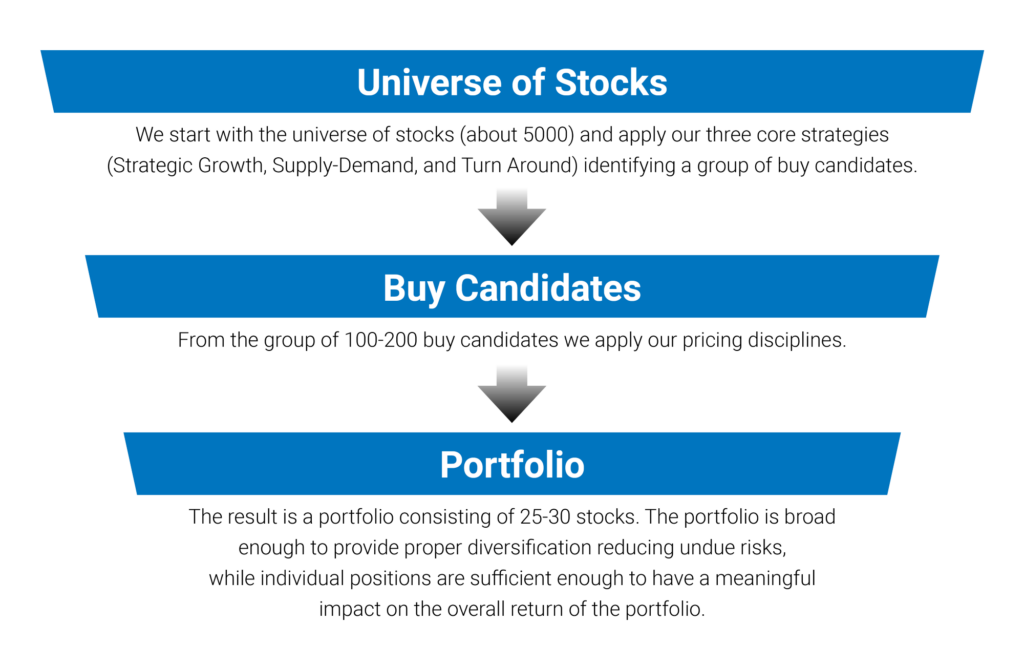

Success for our clients at Pinnacle Capital Management is a result of our disciplined portfolio construction process. Our portfolios are designed to be broad enough to provide proper diversification so as to reduce undue risks, while individual positions are sufficient enough to have a meaningful impact on the overall return of the portfolio. The equity portion of our portfolios usually consists of 25 to 30 different stocks. The securities making up the fixed income component of our portfolio vary based on the criteria outlined in the Fixed Income Selection section below.

The overall allocation between equity and fixed income is determined by matching our clients’ investment objectives to one of our portfolios, which are categorized as Aggressive Growth, Growth, Balanced, Moderate, and Conservative. We also offer an Active Asset Allocation (AAA) portfolio for those clients who wish for their portfolio to be managed according to an asset allocation strategy utilizing multiple asset classes. The AAA portfolio is constructed with exchange-traded funds in multiple asset classes designed to compliment and be used in conjunction with our traditional equity investment selections.

Three core evaluation strategies are utilized when identifying potential companies to invest in for the equity portion of our client portfolios. A thorough analysis is performed on these companies identified by our core strategies to determine if a potential investment opportunity is present. Consequently, if an attractive investment opportunity exists, buy and sell price targets are set for the stock. Companies and their stock are consistently evaluated for evidence that could change our investment rationale. Our core equity strategies and pricing targets are outlined below.

The Sustained Growth Strategy identifies companies with characteristics that enable them to experience continued growth. These companies are likely to have extended periods of rising sales and profits. Factors taken into consideration are overall business strategy, stage in the business life cycle, barriers to entry, level of demand, competitive strengths and weaknesses, and the current economic environment.

The Supply-Demand Strategy is utilized to identify cyclical companies whose profit fluctuates significantly during an economic cycle due to rising and falling demand of their products. A low-demand environment can cause a company’s depreciated stock price to become an attractive investment opportunity. Adjustments a company makes to capacity at the bottom of the economic cycle often result in higher product prices, company profits, and ultimately stock price.

The Turn Around Strategy identifies companies who compete in viable industries that have experienced a substantial reduction in profitability compared to their peers. The existence of a catalyst must exist for consideration for the purchase of the stock. Catalyst includes the emergence of an activist shareholder, change in company leadership, or the existence of proprietary assets that outside parties covet.

The key to success after identifying companies using our core strategies is making sure we buy and sell the stocks at appropriate prices by determining price targets. Establishing price targets involves determining the current fair value and future value of security using projected earnings and cash flow analysis. Buy price targets are set at a discount to the fair value and sell price targets are set at a premium to the fair value. Price targets are routinely re-evaluated and adjusted with ongoing analysis and passage of time.

A number of different criteria are taken into consideration when investing in fixed income securities for our clients. These include, but are not limited to, maturity, duration, yield, credit quality, current economic environment, and trading environment. We also take client-specific needs into consideration when selecting fixed-income investments. These include, but are not limited to, account registration, tax status, income requirements, time horizon, the amount invested, and liquidity needs. Client-specific criteria will dictate whether we select corporate and/or tax-free municipal bonds, short, intermediate, and/or long-term maturities, and/or the utilization of mutual and/or exchanged-traded funds. Generally, a bond must be investment-grade-rated to be considered for purchase. Like our equity investments, fixed income securities are continually monitored and may be adjusted in order to meet our clients’ investment objectives.